Earn on your unused CPU and help the EOS network!

The latest trend on the EOS mainnet seems to be about earning tokens on anything: Earn EOS through REX and voter/proxy rewards, DAPP tokens through staking to DSP stake services, or EIDOS through “CPU mining”.

Another idea for EOS token holders could be to earn by renting out their unused CPU time to dapps or users in need of CPU. While similar in nature to the EIDOS idea, this proposed solution would actually help the network on top of passive earnings.

Rent out unused CPU and earn CPU tokens

Depending on your view, the EOS mainnet is currently in a CPU crisis or works great and as expected. However, we can all agree on that only three types of accounts can currently operate on the chain:

- Accounts with a high amount of CPU staked.

- Accounts that were able to rent CPU from REX in time. More than 80% of lendable REX is currently borrowed driving the REX borrowing prices to new record highs. This went on until it became impossible to borrow from REX anymore.

- Accounts interacting with dapps that pay for their users’ CPU, or that rely on the generosity of a third-party paying for their CPU, like Bloks does with their free 5 transactions per day.

Most accounts seemed to be borrowing CPU from REX as it was initially a cheap way to get more CPU through the Bancor-like pricing algorithm. A big flaw is that REX CPU rentals last for 30 days. The average user just wants to make a transfer, approve an msig, or play on a casino dapp for 30 minutes until they go on with their non-blockchain lives. But they have to rent CPU from REX for 30 days, not utilizing their allotted share of the network bandwidth most of the time. On top of that, it’s hard to estimate how much CPU time and thus staked EOS one needs for their transactions, leading to aggressive over-renting of REX resources. This results in the EOS network still not operating at full capacity despite the high CPU prices and users complaining that they cannot use the blockchain. It only makes sense to provide a way for users to rent our their CPU to other users when they don’t need it. Luckily, EOSIO 1.8 introduced a feature that allows anyone to pay for the costs of any transaction of any user.

The idea would be that users open their CPU bandwidth to anyone and earn a CPU token whenever anyone uses their CPU. This CPU token is paid for by the one utilizing the bandwidth, meaning, using this service requires first owning a CPU token yourself and transferring it to the CPU payer. The CPU token will be listed on DEXes and markets will evolve around it as it has a value/utility. At this point, users can decide to “earn” and trade it against EOS, or make use of its utility to send a transaction when in need of CPU.

♻️ It might seem like we’ve gone full circle: EOSIO moves away from explicit transaction costs as implemented by Ethereum’s gas model, replacing it with an implicit inflation and staking model; but now we could pay for a transaction again by owning an explicit CPU/GAS token. The difference is you now have a choice. Either stake your tokens or pay explicitly per transaction.

Proof of concept

The beauty of this idea is that it can be implemented quite elegantly in a couple of lines. Despite the CPU token, there’s only a single smart contract method required:

// pseudo code

ACTION payforcpu(name cpu_payer, name cpu_user) {

require_auth2(cpu_payer, N(payforcpu));

// make sure that payforcpu auth is not enough to bill

require_auth2(cpu_user, N(active));

// move 1 CPU token from user to payer

transfer(cpu_user, cpu_payer, asset(1, CPU), "");

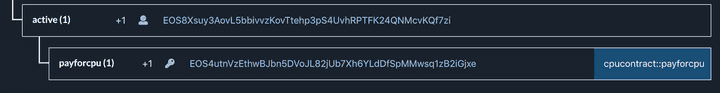

}Anyone willing to earn on their unused CPU would just need to create a new payforcpu permission and make sure to linkauth it to the payforcpu action.

And now they leak their private key for the payforcpu action.

This sounds like a huge security concern, but it is not.

Because of the linkauth, the only action one can use the key for is the payforcpu action.

And whenever someone uses your key and invokes this action to bill in your name, you receive 1 CPU token.

Just as desired.

In fact, we can make the process even easier if everyone agrees on a common CPU public and private key pair.

Let’s say everyone that wants to rent out their CPU uses this key for their payforcpu permission:

Public key: EOS4utnVzEthwBJbn5DVoJL82jUb7Xh6YLdDfSpMMwsq1zB2iGjxe

Private key: 5Ji1r2eRS1zbB883Wt18m56fVUSsG83QerdVyUv7hou96AaEF8TFrom a user or dapp borrower perspective, the service works like this:

- Make sure you own some CPU tokens

- Find someone that offers their CPU. This can be done by lenders registering themselves on the smart contract, or just by calling the

get_key_accountsendpoint with the common CPU public key. (Some check has to be done to see if a lender actually has enough bandwidth leftover.) - Prepare any transaction and insert a

payforcpuaction as the first action. Declare the lender’spayforcpupermission as the first authorization, and the permission of the payer as the second authorization. Sign it with the shared common CPU “private” key and your secret key for the payer permission. Because of theONLY_BILL_FIRST_AUTHORIZERfeature, the CPU costs of the transaction are billed only to the account declared as the first authorizer, the lender.

Challenges

There are a couple of challenges that would still need to be solved:

- Transactions are not equal. The unit of measurement of CPU is the execution time in microseconds. In an ideal world, you would instead pay 1 CPUMICROSECONDS token for each microsecond executed, but this is technically not possible in a smart contract. Smart borrowers will batch their actions into a single transaction and still only have to pay 1 CPU token.

- Maybe lenders only want to rent part of their CPU up to a percentage, to still have some CPU for their own transactions. Setting a threshold would solve this but seems technically impossible again without going off-chain. The problem isn’t as severe though, because they earned CPU tokens and can just use these instead.

- Lenders without left-over CPU bandwidth cannot be used and should be filtered out. The good thing is that lenders are not NFTs, they are fungible 😃 It doesn’t matter whose CPU we use. Someone would probably come up with a centralized API that always returns a lender with enough free CPU.

- What would happen with REX? I imagine someone would rent CPU from REX just to rent it out again through this system as long as it’s profitable.

- There are probably other economic issues I haven’t thought of.